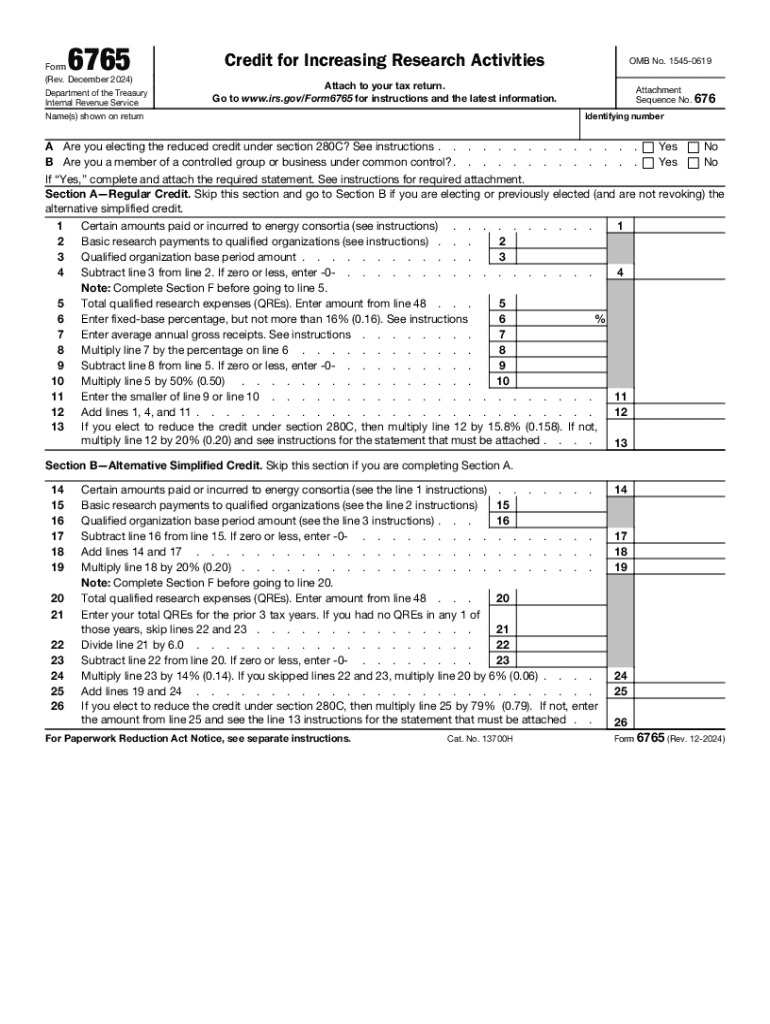

IRS 6765 2025-2026 free printable template

Instructions and Help about IRS 6765

How to edit IRS 6765

How to fill out IRS 6765

Latest updates to IRS 6765

All You Need to Know About IRS 6765

What is IRS 6765?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 6765

What should I do if I realize I've made an error on my IRS 6765 after filing?

If you discover a mistake on your filed IRS 6765 form, you can submit an amended version using Form 1040-X for individuals or the appropriate method for businesses. Make sure to detail the corrections made and include any supporting documentation. It's advisable to also track the status of your amendment to confirm it has been processed.

How can I verify if my IRS 6765 form has been received and processed by the IRS?

To check the status of your IRS 6765 submission, use the IRS 'Where’s My Refund?' tool or contact the IRS directly. Keep in mind that it might take some time for your submission to be updated in their system, particularly during peak filing season.

What are some common mistakes to avoid when filing the IRS 6765?

Common errors when completing the IRS 6765 include miscalculating credits, neglecting to sign the form, and failing to include necessary supporting documentation. To reduce the likelihood of mistakes, double-check your calculations and ensure that all required fields are filled accurately.

Are there any special considerations for nonresidents filing the IRS 6765?

Nonresidents filing the IRS 6765 should ensure they comply with specific IRS requirements, which may include obtaining an Individual Taxpayer Identification Number (ITIN) if they don't have a Social Security Number. Additionally, understanding the eligibility of certain credits is crucial as they may differ for nonresident filers.

What should I do if my e-filed IRS 6765 is rejected?

If your e-filed IRS 6765 is rejected, review the rejection code provided by the IRS, as it will guide you on what corrections are needed. After addressing the issues, you can re-submit the form either electronically or via mail, ensuring all errors are rectified to avoid further delays.