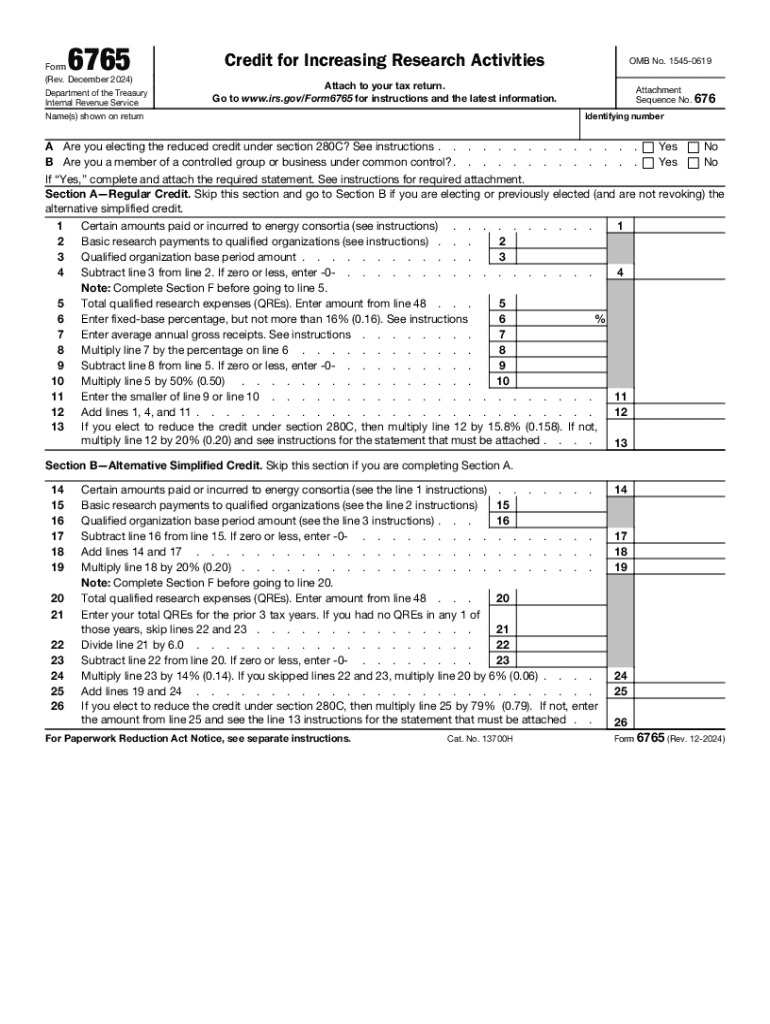

IRS 6765 2025 free printable template

Show details

Cat. No. 13700H Form 6765 Rev. 12-2024 Page 2 Section C Current Year Credit Enter the portion of the credit from Form 8932 line 2 that is attributable to wages that were also used to figure the credit on line 13 or line 26 whichever applies. Amount allocated to beneficiaries of the estate or trust see instructions. Form 3800 Part III line 4i. See instructions. For filers other than eligible small businesses report the credit on Form 3800 Part III line 1c. Schedule K the amount on this line...

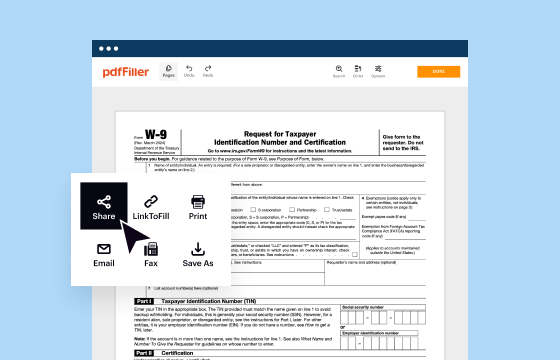

pdfFiller is not affiliated with IRS

Understanding IRS Form 6765: A Comprehensive Guide

Guidelines for Completing IRS Form 6765

Detailed Instructions for Filling Out the Form

Understanding IRS Form 6765: A Comprehensive Guide

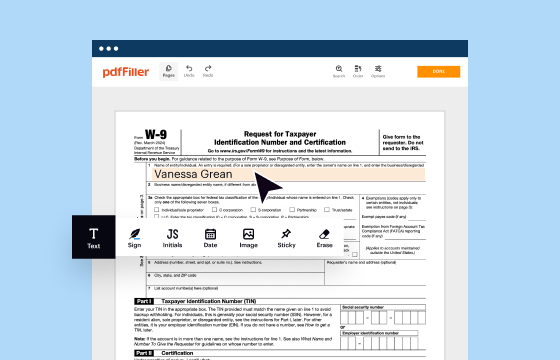

IRS Form 6765, officially known as the Credit for Increasing Research Activities, allows taxpayers to claim tax credits for qualified research expenditures. This form is crucial for businesses engaged in R&D, providing significant financial incentives that can enhance cash flow and promote innovation.

Guidelines for Completing IRS Form 6765

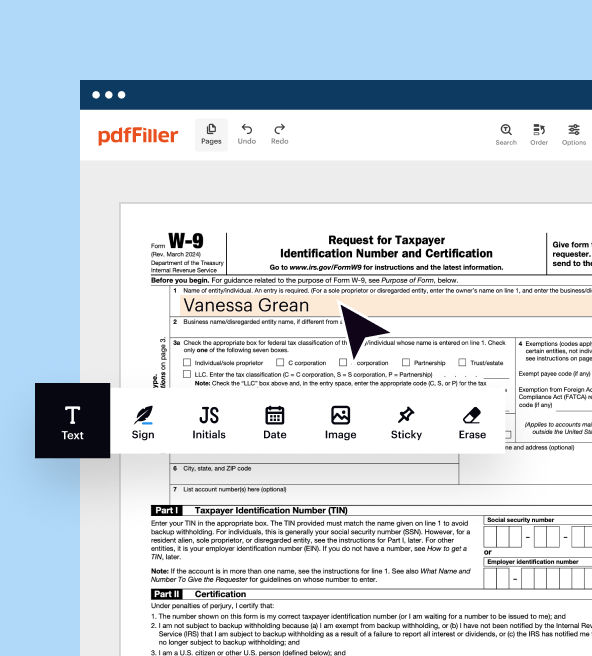

Editing IRS Form 6765 requires careful attention to detail. Follow these steps for accurate submission:

01

Gather all necessary documentation that supports your claim.

02

Review the instructions for Form 6765 to ensure compliance with IRS regulations.

03

Accurately fill out the form, ensuring all financial figures are correctly reported.

04

Double-check all calculations, especially for the credits being claimed.

05

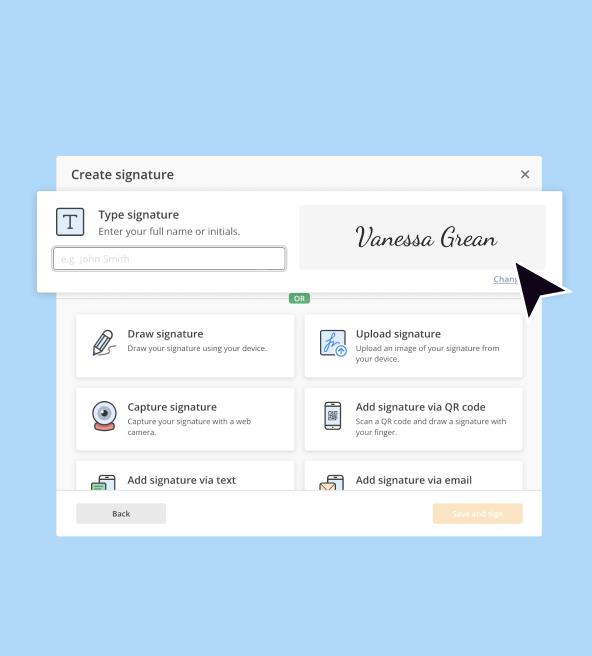

Sign and date the form before submission.

Detailed Instructions for Filling Out the Form

Completing IRS Form 6765 involves several sections that must be filled out completely and accurately:

01

Enter your business details, including name and Employer Identification Number (EIN).

02

List qualified research activities, specifying expenditures in clear categories, such as wages and contract research.

03

Indicate the calculation method for the credit, whether using the regular method or the alternative simplified method (ASM).

04

Provide details on any prior year credits that may affect this year's claim.

Show more

Show less

Recent Updates and Changes to IRS Form 6765

Recent Updates and Changes to IRS Form 6765

Stay informed about important changes to IRS Form 6765 that impact how you file:

01

As of 2023, the income threshold for Qualified Small Businesses has been updated, affecting eligibility for the reduced credit rates.

02

New guidelines clarify which research activities qualify, expanding the definition to include more technological advancements.

03

Changes in the IRS submission process may require additional documentation for certain industries.

Essential Insights into IRS Form 6765

What Exactly is IRS Form 6765?

The Role and Objectives of IRS Form 6765

Who Needs to Submit IRS Form 6765?

Conditions for Exemptions from Filing IRS Form 6765

Components of IRS Form 6765

Filing Deadlines for IRS Form 6765

Comparative Analysis of IRS 6765 with Similar Forms

Covered Transactions on IRS Form 6765

Number of Copies Required for Submission

Consequences of Failing to Submit IRS Form 6765

Information Required for Filing IRS Form 6765

Other Forms Often Submitted with IRS Form 6765

Submission Address for IRS Form 6765

Essential Insights into IRS Form 6765

What Exactly is IRS Form 6765?

IRS Form 6765 is utilized to claim the credit for increasing research activities. This tax incentive is designed to encourage innovation by offsetting certain expenses associated with qualified research and development practices.

The Role and Objectives of IRS Form 6765

The primary purpose of IRS Form 6765 is to allow businesses to offset costs incurred during research activities, effectively lowering their tax liability. This is vital for start-ups and companies venturing into new technological developments.

Who Needs to Submit IRS Form 6765?

IRS Form 6765 must be completed by businesses engaged in research activities that meet the IRS definition. This includes:

01

Corporations and partnerships conducting R&D projects.

02

Start-ups that are developing innovative products or procedures.

03

Companies in sectors such as technology, pharmaceuticals, and manufacturing that qualify under the extensive criteria specified by the IRS.

Conditions for Exemptions from Filing IRS Form 6765

Certain businesses may be exempt from filing Form 6765 based on specific conditions, including:

01

Businesses with gross receipts below a defined threshold for the tax year.

02

Companies that have not had any qualified research expenses.

03

Firms in specific industries or activities defined under IRS guidelines may also be exempt.

Components of IRS Form 6765

Key components of IRS Form 6765 include:

01

Section for business information and tax identification.

02

Details on qualified research activities.

03

Calculation of tax credits based on qualifying expenses.

04

Attachments for supporting documents and prior year credits.

Filing Deadlines for IRS Form 6765

The deadline for submitting IRS Form 6765 typically aligns with your annual tax return filing due dates, which for most businesses is April 15th. If you are filing for an extension, ensure that you also extend the filing of Form 6765 accordingly.

Comparative Analysis of IRS 6765 with Similar Forms

IRS Form 6765 differs from other tax forms, such as:

01

Form 8844 - Employee Retention Credit, which targets businesses retaining workers during economic hardship.

02

Form 8883 - Asset Depreciation, focusing on claims related to depreciable assets used in research.

Covered Transactions on IRS Form 6765

Form 6765 can be utilized for transactions such as:

01

Investments in proposed research and development projects.

02

Wages paid to employees directly involved in R&D activities.

03

Costs associated with prototype testing and experimental design.

Number of Copies Required for Submission

Typically, one original copy of Form 6765 is required for submission to the IRS. However, additional copies may be needed for state tax purposes or internal record-keeping.

Consequences of Failing to Submit IRS Form 6765

Non-compliance with IRS Form 6765 can result in various penalties, including:

01

Financial penalties ranging up to $250 per failure to file.

02

Loss of potential tax credits, translating into increased liabilities.

03

In severe cases, legal action may result in audits or additional scrutiny by the IRS.

Information Required for Filing IRS Form 6765

To file IRS Form 6765 correctly, compile the following information:

01

Your business's EIN and basic identifying information.

02

Details of all qualified research expenditures.

03

Past research credits if applicable.

Other Forms Often Submitted with IRS Form 6765

In certain cases, you may need to accompany Form 6765 with additional forms such as:

01

Schedule C if filing as a sole proprietor.

02

Form 8827 if claiming an investment credit.

Submission Address for IRS Form 6765

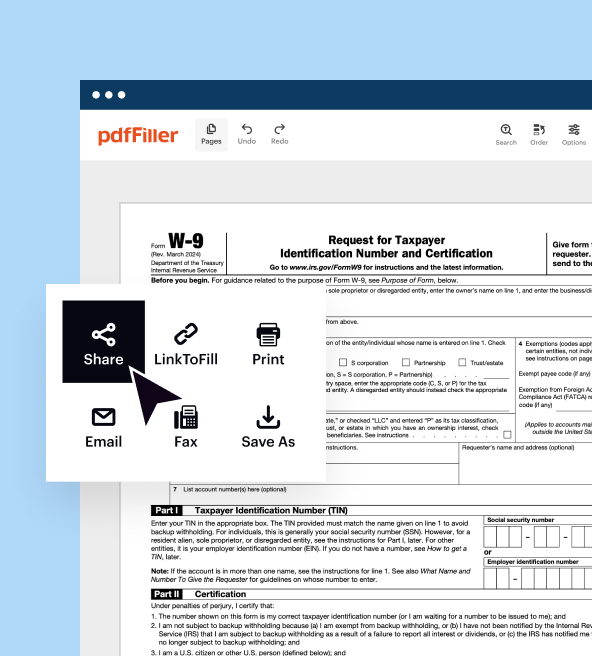

IRS Form 6765 should be submitted to the address specified in the instructions accompanying the form, which typically depends on the form of your business entity and location.

By thoroughly understanding IRS Form 6765, businesses can maximize their research tax credits, ultimately fostering innovation and growth. For personalized assistance, consider reaching out to tax professionals or utilizing platforms such as pdfFiller to streamline your R&D credit filing process.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.